Chevron's Labor Signals Suggest Q2–Q3 Margin Repricing

CVX Thesis while we await the Hess / Exxon arbitration decision announcement.

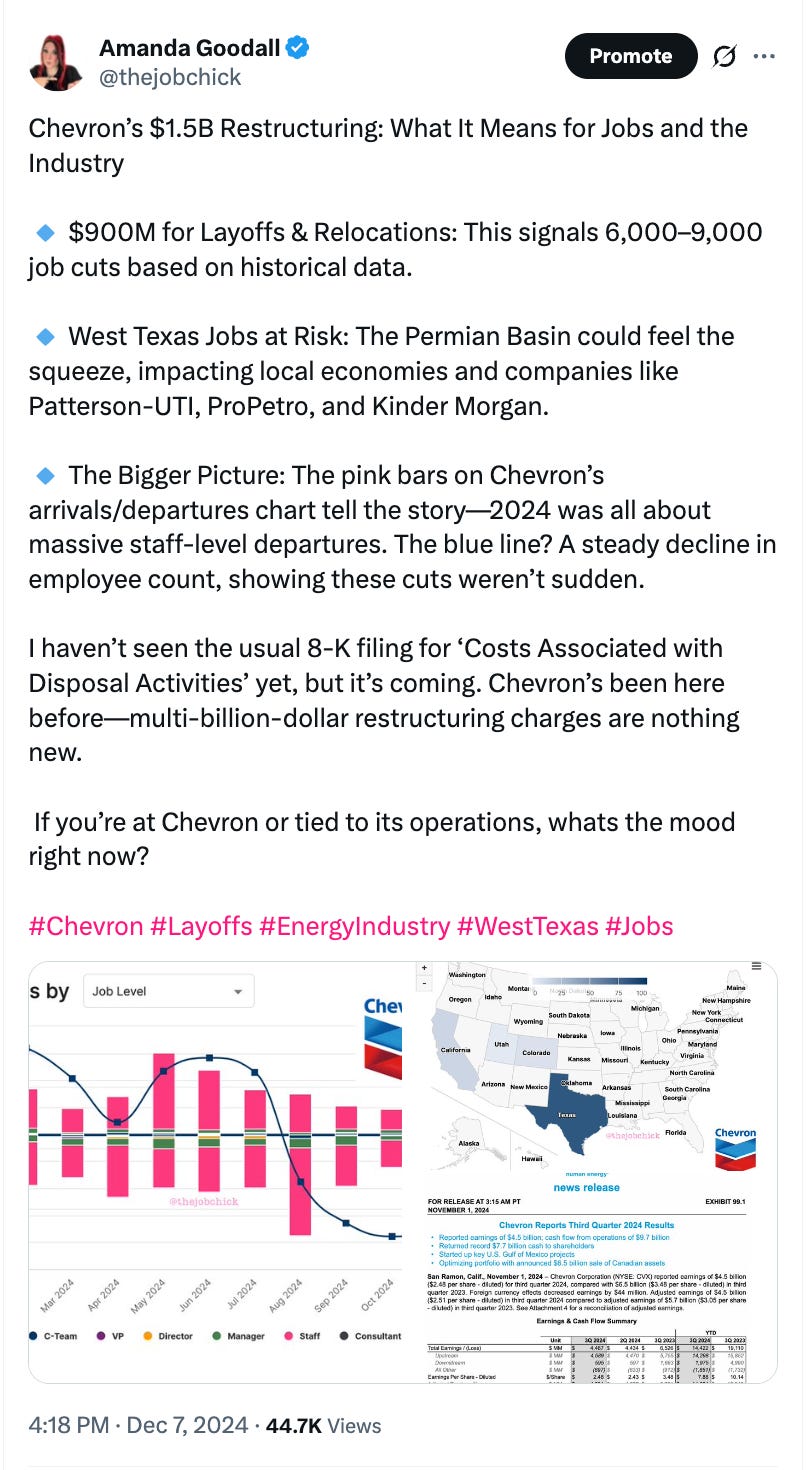

Chevron’s Restructuring Looks Deeper Than Modeled.

Chevron is setting up margin lift over the next 6–12 months, driven by strategic headcount compression.

Let me preface this thesis by saying I follow workforce trends, hence the moniker, The Job Chick. It’s what I know, it’s what I do… and let me just say that labor signals are one of the most important yet highly overlooked signals for all shareholders, traders, etc. I am a featured Analyst on Yahoo Finance for a few companies. Investors are digging this unique take and accuracy.

My thesis is heavily built on the workforce trend lines and analysis with what is happening from an industry level, and all the data that nobody takes into consideration on how labor works in companies.

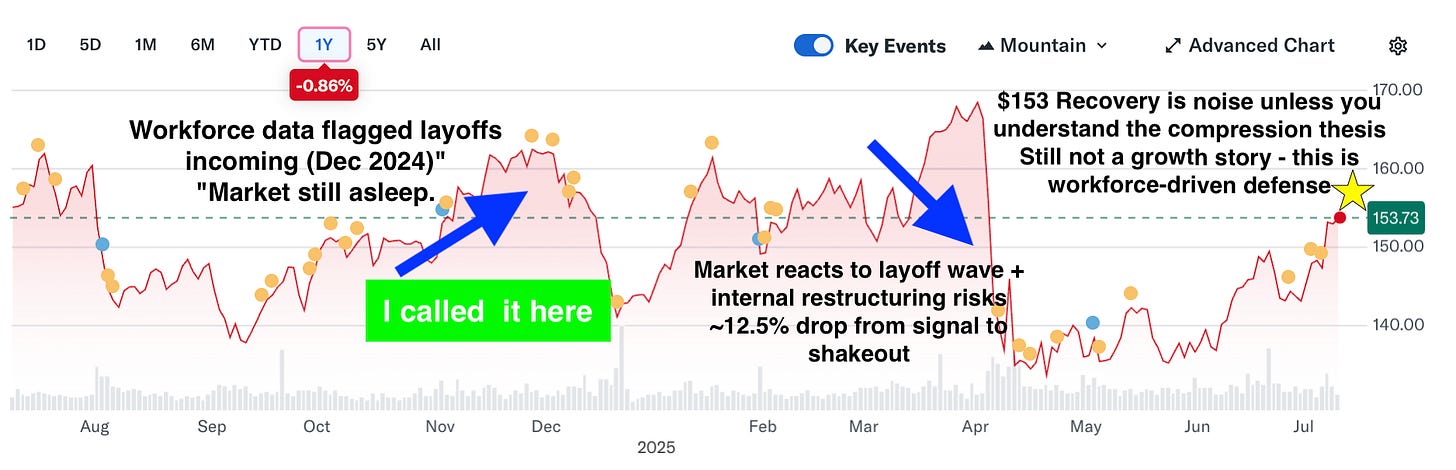

Want to know how spot on workforce insights can be? I called the amount of Chevron layoffs - the 9,000 - announced in February, back in December 2024.

Where I Called It:

Mid-December 2024: Chevron was trading near ~$160, peaking just before the drop.

That’s right before the early January pullback, which coincided with pre-layoff rumors and restructuring signals bubbling inside workforce data (well before press or filings).

What Investors Could’ve Avoided:

Stock dropped to ~$140 in April 2025, as workforce signals turned into hard layoff action and market uncertainty.

That’s a ~12.5% drawdown from the peak, and it punished anyone holding under the “oil is safe” narrative.