JPMorgan’s 88% Hiring Drop Is the Loudest Quiet Signal on Wall Street

Here’s what investors need to watch before Q2 earnings land.

By now, we all know JPMorgan doesn’t flinch unless it has to. So when their hiring levels start to fall off a cliff - down 88% since January - you’d better believe it’s not just a hiring blip.

So here we are.

If you’re an investor, exec, or just trying to stay one step ahead of the next quarter’s mess - ya’ll better start watching the labor signals before the earnings calls and it’s not just about the fact they already stated early this year they were cutting jobs during several months… it’s SO, SO, SO much more.

The Data Wall Street Shouldn’t Ignore

Let’s start with the receipts:

January 2025: ~770 new hires

May 2025: Under 90

That’s a full-blown 88% hiring collapse in five months

Interns? Gone.

Staff hires? REALLY dropped off.

VPs and Consultants? Quietly phased down.

Hiring isn’t slowing - it’s being surgically shut off.

It’s intentional. They know what they are doing.

The CFO Translation Layer

CFO Jeremy Barnum wasn’t exactly subtle at JPMorgan’s Investor Day:

“At the margin, we’re asking people to resist headcount growth…”

Translation:

“Don’t ask for budget. Don’t hire. Stretch your people. And pretend it’s strategy.”

Unless you’re in a high-certainty role (think advisors, bankers, client-facing revenue roles), you’re either working harder or watching your job disappear behind a machine. So yeah, my advice as someone who has watched this company hire and freeze for 20+ years… Don’t apply unless you have a straight in or you are in these types of roles. Save yourself time and a heartbreak.

AI’s Not Coming. It’s Already Here.

Marianne Lake (CEO of Consumer & Community Banking) came with her own friendly nuke:

10% of operations employees cut

AI to “deliver more with less”

I mean - ouch…. harsh… but needed. Fraud, statements, account services - all getting an upgrade via algorithm - no humans needed.

But here’s what most peeps are missing:

This isn’t a pilot program.

It’s a full-scale replacement plan.

Engineers aren’t safe either. Even coders are using AI tools to cut their own keystrokes.

As Barnum put it:

“It’s not just the amateurs who are helped by these tools…”

Welcome to the era of self-disruption, where even top talent is automating themselves out of the headcount spreadsheet.

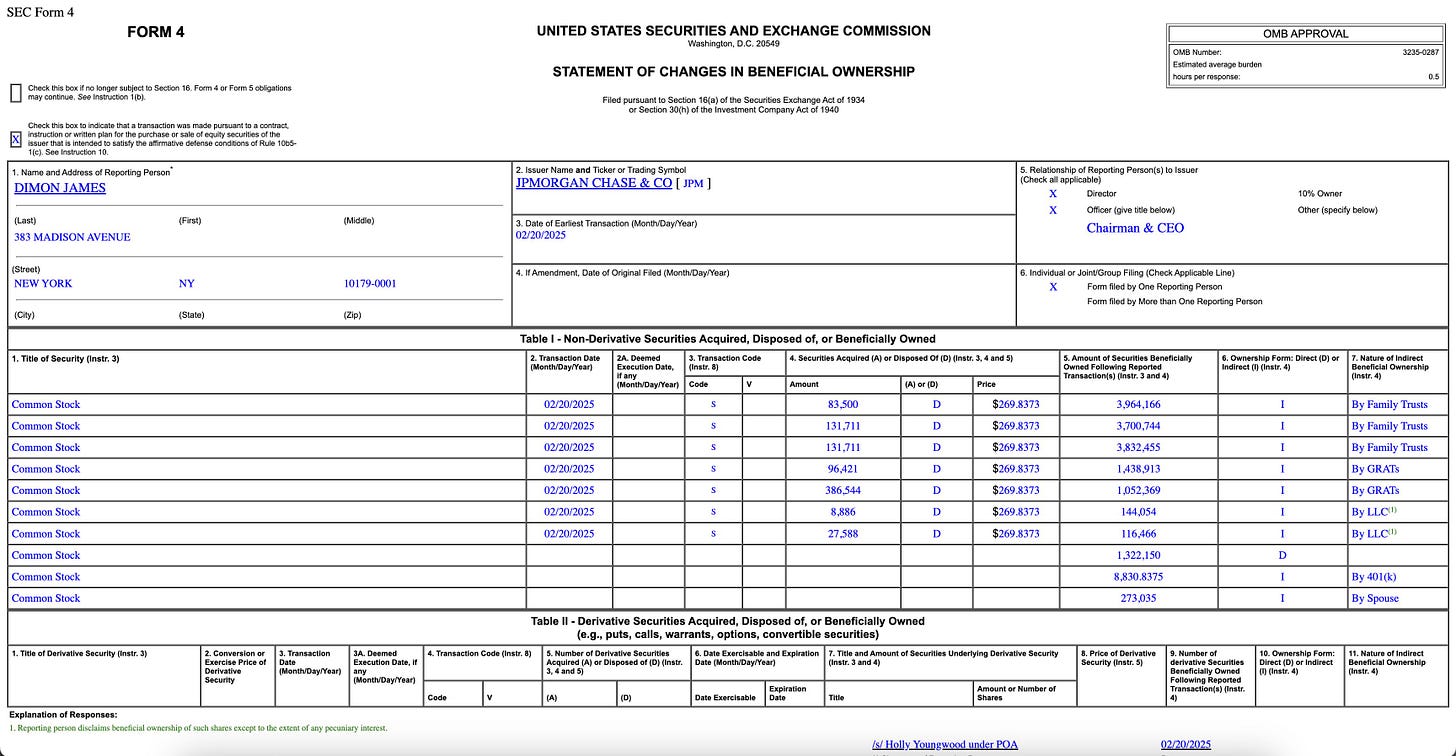

Remember when everyone lost their mind over Jamie Dimon selling shares in early 2025?

Jamie Dimon’s $233M stock sale wasn’t random at all. It was pre-planned under a Rule 10b5-1 plan adopted on 11/7/2024, and disclosed in January 2025.

He sold 1M shares through August... however, I'd like to talk timing.

JPM knew layoffs were coming when this plan was filed. Workforce reductions aren’t last-minute decisions.